HP TRONIC Group has concluded a share buyback agreement with Genesis Capital

22.04.2024HP TRONIC, whose portfolio includes the electronics retailer DATART and the brand ETA, has agreed with Genesis Private Equity Fund III (GPEF III) of the Genesis Capital group to buy-back all the shares held by the fund. As a result, 100% of the shares are now within the corporate structure of the HP TRONIC Group, strengthening control over strategic decisions and allowing for flexibility and autonomy in future development.

Genesis Capital divests its portfolio company SANBORN to Oriens

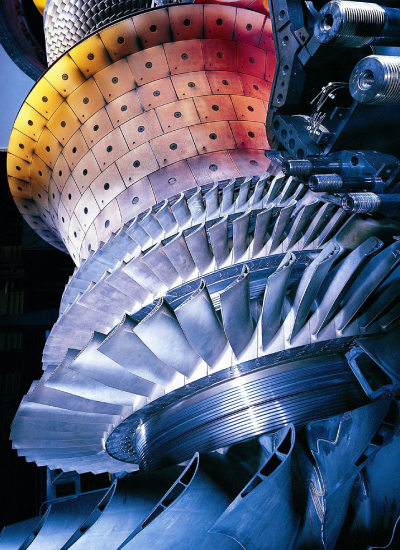

04.12.2023SANBORN, a key supplier of precision components and specialized parts for the power generation, oil & gas and transportation industry changes ownership. Genesis Private Equity Fund III (GPEF III) from the established private equity group Genesis Capital, sold its majority ownership stake in the company to Oriens.

Genesis Capital and Avallon MBO private equity funds have successfully finalized the sale of Stangl Technik Holding. SPIE, the independent European leader in multi-technical services, became a new majority shareholder on 3 August 2022.

03.08.2022On 15 June 2022, Genesis Private Equity Fund III (GPEF III) and Avallon MBO Fund II signed an agreement to divest a majority ownership stake in Stangl Technik Holding, a leading provider of comprehensive engineering and technical building services in Poland and the Czech Republic. The closing of the transaction was subject to Polish anti-monopoly authority approval. Given the satisfaction of all pre-closing conditions, the transaction has been closed as of today.

Genesis Capital and Avallon MBO private equity funds announce an agreement for the divestment of Stangl Technik Holding to be acquired by SPIE, the independent European leader in multi-technical services.

16.06.2022Stangl Technik Holding, a leading provider of comprehensive engineering and technical building services in Poland and the Czech Republic, will change its ownership. Genesis Private Equity Fund III (GPEF III) and Avallon MBO Fund II have agreed with SPIE on the sale of a majority ownership stake. The closing of the transaction is expected to take place in July 2022 and is subject to approval by the Polish anti-monopoly authority.

The largest Czech call centre operator Conectart acquires Atoda

05.04.2022Conectart with its more than two thousand call centre operators, is the largest contact centre service provider in the Czech Republic. Since the beginning of April, it has further strengthened its position via the acquisition of Atoda, a regional call centre running its branches mainly in southern Bohemia and employing approximately four hundred operators. As a new subsidiary of Conectart, Atoda became part of GPEF III fund of Genesis Capital, which had acquired Conectart in 2020.

Genesis Capital sells its portfolio company QUINTA-ANALYTICA to BBA Capital Partners

30.11.2021QUINTA-ANALYTICA, an established Czech provider of R&D and regulatory services for the pharmaceutical, biotechnology and generic drug industries changes ownership. Genesis Private Equity Fund III (GPEF III) from the established private equity group Genesis Capital, sold its 85.9% ownership stake in the Company to LVA Holding GmbH, a portfolio company of BBA Capital Partners (BBA).

Ciklum acquires CN Group from Genesis Capital to expand its European presence

31.08.2021The acquisition will strengthen Ciklum’s position in the CEE and DACH markets.

Ciklum, a global product engineering and digital services company, today announced its acquisition of CN Group, a Czech-based software development firm from Genesis Capital, one of the leading CEE private equity funds. With the acquisition deal, Genesis Capital, who invested in CN Group in 2019, has sold 100% of its shareholding to Ciklum.

The deal will facilitate Ciklum’s ambitious growth plans in the CEE and DACH markets.

KKCG Group sells largest Czech call centre, Conectart, to Genesis Capital Group

18.05.2020Karel Komárek's KKCG investment group has sold the largest operator of contact centres in the Czech Republic. Conectart, which now operates call centres in eight towns in the country, employing over a thousand operators, will become part of the portfolio of the Genesis Private Equity Fund III (GPEF III) of the Genesis Capital group. The transaction is expected to be concluded in the summer and is subject to approval by the Office for the Protection of Competition.

HR changes in Genesis Capital

06.04.2020Genesis Capital Equity, a private equity firm within the Genesis Capital group, has the pleasure to announce that the position of Managing Partner is now held by Ondřej Vičar who has been working for Genesis Capital since 2007. He replaces Jan Tauber who founded Genesis Capital more than 20 years ago and developed it into one of the biggest players in the field of private equity in Central Europe. The change among management represents the conclusion of the natural succession process within the group and is also done in the context of the planned launch of a new fund – Genesis Private Equity Fund IV. The process involves a series of other promotions within the investment team.

Genesis and Espira join V4C in Summa Linguae Technologies

21.02.2020Private equity firms Genesis Capital and ESPIRA Investments have acquired an interest in V4C’s investment in Summa Linguae Technologies, the Warsaw New Connect listed multilingual data management company.

Genesis enters family entertainment, acquires majority in 11 Entertainment Group of Hungary

03.09.2019Genesis Private Equity Fund III (GPEF III), a private equity fund advised by Genesis Capital, has signed the acquisition of 61% of 11 Entertainment Group, provider of indoor family entertainment in Hungary. GPEF III partnered with the business founder, Mr. Stefan Fritsch, to build a family entertainment specialist in the CEE region. It is the eighth investment of GPEF III and its historically first independent investment in Hungary.

Genesis Fund Enters the IT Sector, Acquires Software Development company CN Group

01.03.2019Genesis Private Equity Fund III (GPEF III), a private equity fund advised by Genesis Capital, has completed the acquisition of 96 % of the Danish owned and Prague based company CN Group, an IT company providing nearshore software programming, QA management, testing and computer-aided modelling (CAD). It is the seventh investment for GPEF III, which has approximately 82 million EUR available for investments to small and medium-sized enterprises in the Czech Republic, Slovakia and neighbouring countries of Central Europe.

Tomáš Sýkora, Patria Finance’s chief analyst, joins Genesis Capital

15.08.2018Tomáš Sýkora, Patria Finance’s chief analyst, is joining Genesis Capital, the leading private equity firm in the Czech Republic and Slovakia. The latest major addition to the company’s analytical team is completing the personal strengthening undertaken at Genesis Capital in recent months. Since May, the team has welcomed Tatiana Balkovicová and Martin Viliš, experts in financial advisory and acquisition financing, respectively, CFO Petr Janovský, and analyst Adam Ruta.

Tatiana Balkovicová and Martin Viliš reinforce Genesis Capital

17.07.2018Genesis Capital, a leading private equity firm in the Czech Republic and Slovakia, has won two prominent experts for its team. Tatiana Balkovicová comes from Deloitte and Martin Viliš comes from Česká spořitelna. They are experienced professionals with managerial experience from financial advisory services and acquisition financing.

Genesis sells its share in POS Media Group to DemoPower Thailand

15.05.2018DemoPower, a member of Omni Marketing Global, the leading retail marketing firm operating predominantly in markets across Asia Pacific, acquires the share in POS Media Group from Genesis Equity Fund III (GPEF III). The synergies of POS Media and Omni Marketing Global are opening the way to a major expansion both on current and new markets. The controlling share remains in the ownership of the founder and CEO of the Company, Mr Richard van het Bolscher. The transaction marks the first successful exit of the Genesis’ latest fund.

Genesis partners with the Polish fund Avallon to acquire EQOS Energie’s Polish and Czech operations

15.02.2018Poland-based Avallon MBO Fund II and Czech-based Genesis Private Equity Fund III (GPEF III) team up to acquire EQOS Energie Polska Sp. z o.o. and EQOS Energie Česko spol. s r.o. Both companies have previously been part of the international EQOS Energie Group, one of the leading providers of services in comprehensive technical infrastructures in Europe, backed by the German-Swedish private equity firm Triton. Upon transaction closing, the Czech and Polish companies will operate under a new brand Stangl Technik. For GPEF III, the transaction marks its sixth investment and its historically first deal in Poland. Transaction closing is subject to approval by the Polish anti-monopoly authority.

Genesis gains a majority stake in Sanborn

29.11.2017Genesis Private Equity Fund III (GPEF III) will gain a significant majority stake in the manufacturing company Sanborn. The company is focused on manufacturing of specialized parts for equipment in the power, petrochemical and transport industries. With entry of GPEF III, the management team of the company will be strengthened by a new CEO, Mr. Aleš Tichý.

DEIMOS with support of the Genesis fund builds D2G

27.11.2017DEIMOS, a mechanical engineering company, with support of the Genesis Private Equity Fund III (GPEF III) builds an industrial group D2G

DATART and HP TRONIC merged, with Genesis fund gaining a share

26.10.2017DATART, one of the biggest retail entities in the Czech Republic, merged with HP TRONIC, the operator of the Euronics retail chain and owner of the Kasa.cz and Hej.sk e-shops, on 25 October 2017. The newly created entity will represent both companies, which have been operating separately to date, on the retail market. The structure received a capital contribution from Genesis Private Equity Fund III, which gained a material minority share. ČSOB and Česká spořitelna founded the acquisition. The merger was approved by the Office for the Protection of Competition in the Czech Republic and the Antimonopoly Office of the Slovak Republic.

DATART and HP TRONIC to merge, Genesis fund gaining a material minority share

13.06.2017The owners of the respective companies have agreed to combine DATART, one of the biggest retail entities in the Czech Republic, with HP TRONIC, the operator of the Euronics retail chain and owner of the Kasa.cz and Hej.sk e-shops. The newly created structure will represent both companies, which have been operating separately to date, on the retail market. The structure will receive a capital contribution from Genesis Private Equity Fund III, which will gain a material minority share.

Genesis Fund enters a new industry, acquiring a stake in POS Media Group

15.03.2017Genesis Private Equity Fund III (GPEF III), which was launched last year, announces its latest investment. The Fund acquires a 47% share in POS Media Group, a provider of point-of-sale advertising and in-store communications solutions. The main partners of the Group include leading retail chains in several countries across Central and Eastern Europe. Following the acquisition of a majority stake in the pharmaceutical company QUINTA-ANALYTICA, POS Media Group represents the second investment of GPEF III, which has a total of over EUR 80 million in committed capital for investments into small and medium-sized enterprises in the Czech Republic, Slovakia, Poland, Hungary and Austria.

Genesis Capital: Genesis Private Equity Fund III has secured over CZK 2 billion for equity investments into SMEs, part h

15.09.2016Genesis Private Equity Fund III (GPEF III), fourth in the line of private equity funds advised by Genesis Capital, has completed its fundraising. The fund has secured more than EUR 80 million (CZK 2.2 billion), mostly from institutional investors. These resources are now available for investment into small and medium-sized enterprises in the Czech Republic and Slovakia and partly also in Poland, Hungary and Austria. The first investment has already been made, others are in negotiation.

Genesis Fund Enters the Pharmaceutical Sector, Acquires QUINTA-ANALYTICA

08.06.2016Genesis Private Equity Fund III (GPEF III), a private equity fund advised by Genesis Capital, has completed the acquisition of 75 % of the company QUINTA-ANALYTICA, an established provider of R&D and regulatory services for pharmaceutical, biotechnology and generic drug industries. It is a first investment for GPEF III, which has approximately 80 million EUR available for investments to small and medium-sized enterprises in Czech Republic and Slovakia.

GPEF III: Over EUR 60 million reserved for financing of growth and buyouts of small- and medium- sized enterprises

01.02.2016Last August, Genesis Capital announced the launch of the fourth fund focused on investments on Czech and Slovak SMEs – Genesis Private Equity Fund III (GPEF III). At First Closing, the fund had EUR 45 million at its disposal. Thanks to the considerable interest from investors, the size of commitments has recently passed the EUR 60 million mark (over CZK 1.6 billion). The Fund’s investors include Česká spořitelna, eQ Private Equity and the European Investment Fund, Genesis Capital's long-standing partners. They have been joined by Komerční banka's Investment Company (IKS KB), through which private individuals can invest into Czech and Slovak enterprises alongside their institutional counterparts, together with Kooperativa, Česká podnikatelská pojišťovna, and a local family office.

Traditional investors joined by other reputable institutions in GPEF III. Private individuals can invest in GPEF III via Komerční banka's IKS

01.02.2016Genesis Private Equity Fund III is receiving strong interest from Czech and international investors. The traditional names such as European Investment Fund, Česká spořitelna or eQ Private Equity of Finland have been joined by Komerční banka's Investment Company (IKS KB), Kooperativa and Česká podnikatelská pojišťovna, and a local family office. The final size of the Fund will likely be increased thanks to the continuing demand from international institutional investors.

Genesis Capital’s team to add a prominent lawyer - Pavel Kvíčala, and an investment analyst - Ondřej Hýla.

01.02.2016Genesis Capital’s team to add a prominent lawyer and an investment analyst. Pavel Kvíčala joins Genesis from Havel, Holásek & Partners, Ondřej Hýla has background in consulting, having worked for Deloitte Advisory Services.

Another EUR 45 million for small and medium-sized enterprises. Genesis Capital launches a new private equity fund – GPEF III.

05.08.2015Genesis Capital, one of the largest providers of private equity in the Czech Republic and Slovakia, has announced the launch of a new fund – Genesis Private Equity Fund III (GPEF III), the fourth fund Genesis Capital will have managed in the 15 years since its establishment. As its predecessors, GPEF III will focus on investments into Czech and Slovak small and medium-sized enterprises with high growth potential. At launch time, the fund has EUR 45 million at its disposal, but its size may increase up to EUR 80 million. Investors include Česká spořitelna and the European Investment Fund, Genesis Capital's two long-standing partners. They have been joined by Komerční banka's Investment Company (IKS KB), through which private individuals can invest into Czech and Slovak enterprises alongside their institutional counterparts.