Tomáš Sýkora, Patria Finance’s chief analyst, joins Genesis Capital

15.08.2018Tomáš Sýkora, Patria Finance’s chief analyst, is joining Genesis Capital, the leading private equity firm in the Czech Republic and Slovakia. The latest major addition to the company’s analytical team is completing the personal strengthening undertaken at Genesis Capital in recent months. Since May, the team has welcomed Tatiana Balkovicová and Martin Viliš, experts in financial advisory and acquisition financing, respectively, CFO Petr Janovský, and analyst Adam Ruta.

Tatiana Balkovicová and Martin Viliš reinforce Genesis Capital

17.07.2018Genesis Capital, a leading private equity firm in the Czech Republic and Slovakia, has won two prominent experts for its team. Tatiana Balkovicová comes from Deloitte and Martin Viliš comes from Česká spořitelna. They are experienced professionals with managerial experience from financial advisory services and acquisition financing.

Genesis sells its share in POS Media Group to DemoPower Thailand

15.05.2018DemoPower, a member of Omni Marketing Global, the leading retail marketing firm operating predominantly in markets across Asia Pacific, acquires the share in POS Media Group from Genesis Equity Fund III (GPEF III). The synergies of POS Media and Omni Marketing Global are opening the way to a major expansion both on current and new markets. The controlling share remains in the ownership of the founder and CEO of the Company, Mr Richard van het Bolscher. The transaction marks the first successful exit of the Genesis’ latest fund.

Genesis partners with the Polish fund Avallon to acquire EQOS Energie’s Polish and Czech operations

15.02.2018Poland-based Avallon MBO Fund II and Czech-based Genesis Private Equity Fund III (GPEF III) team up to acquire EQOS Energie Polska Sp. z o.o. and EQOS Energie Česko spol. s r.o. Both companies have previously been part of the international EQOS Energie Group, one of the leading providers of services in comprehensive technical infrastructures in Europe, backed by the German-Swedish private equity firm Triton. Upon transaction closing, the Czech and Polish companies will operate under a new brand Stangl Technik. For GPEF III, the transaction marks its sixth investment and its historically first deal in Poland. Transaction closing is subject to approval by the Polish anti-monopoly authority.

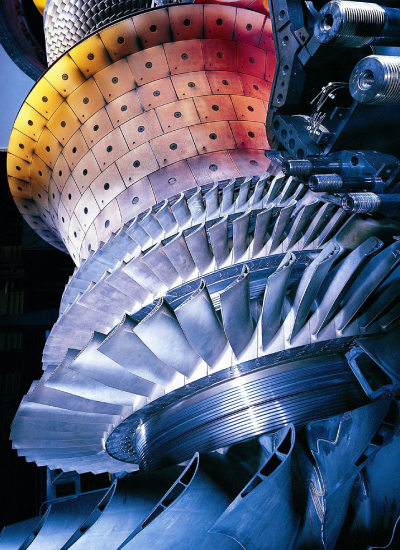

Genesis gains a majority stake in Sanborn

29.11.2017Genesis Private Equity Fund III (GPEF III) will gain a significant majority stake in the manufacturing company Sanborn. The company is focused on manufacturing of specialized parts for equipment in the power, petrochemical and transport industries. With entry of GPEF III, the management team of the company will be strengthened by a new CEO, Mr. Aleš Tichý.

DEIMOS with support of the Genesis fund builds D2G

27.11.2017DEIMOS, a mechanical engineering company, with support of the Genesis Private Equity Fund III (GPEF III) builds an industrial group D2G

DATART and HP TRONIC merged, with Genesis fund gaining a share

26.10.2017DATART, one of the biggest retail entities in the Czech Republic, merged with HP TRONIC, the operator of the Euronics retail chain and owner of the Kasa.cz and Hej.sk e-shops, on 25 October 2017. The newly created entity will represent both companies, which have been operating separately to date, on the retail market. The structure received a capital contribution from Genesis Private Equity Fund III, which gained a material minority share. ČSOB and Česká spořitelna founded the acquisition. The merger was approved by the Office for the Protection of Competition in the Czech Republic and the Antimonopoly Office of the Slovak Republic.

DATART and HP TRONIC to merge, Genesis fund gaining a material minority share

13.06.2017The owners of the respective companies have agreed to combine DATART, one of the biggest retail entities in the Czech Republic, with HP TRONIC, the operator of the Euronics retail chain and owner of the Kasa.cz and Hej.sk e-shops. The newly created structure will represent both companies, which have been operating separately to date, on the retail market. The structure will receive a capital contribution from Genesis Private Equity Fund III, which will gain a material minority share.

Genesis Fund enters a new industry, acquiring a stake in POS Media Group

15.03.2017Genesis Private Equity Fund III (GPEF III), which was launched last year, announces its latest investment. The Fund acquires a 47% share in POS Media Group, a provider of point-of-sale advertising and in-store communications solutions. The main partners of the Group include leading retail chains in several countries across Central and Eastern Europe. Following the acquisition of a majority stake in the pharmaceutical company QUINTA-ANALYTICA, POS Media Group represents the second investment of GPEF III, which has a total of over EUR 80 million in committed capital for investments into small and medium-sized enterprises in the Czech Republic, Slovakia, Poland, Hungary and Austria.

Genesis Fund sells SWELL. The new strategic owner will be the international group Altran

25.10.2016By the end of October, SWELL a.s., the leading Czech provider of services in applied research and development for automotive industry, based in Hořice, Hradec Králové Region, will have changed its ownership. Genesis Private Equity Fund II (GPEF II), which was the owner of 96% stake, sold its share to the international group Altran. Together with GPEF II also the executive managers of SWELL sold their minority stake, and Altran becomes the sole owner of the company.

Genesis Capital: Genesis Private Equity Fund III has secured over CZK 2 billion for equity investments into SMEs, part h

15.09.2016Genesis Private Equity Fund III (GPEF III), fourth in the line of private equity funds advised by Genesis Capital, has completed its fundraising. The fund has secured more than EUR 80 million (CZK 2.2 billion), mostly from institutional investors. These resources are now available for investment into small and medium-sized enterprises in the Czech Republic and Slovakia and partly also in Poland, Hungary and Austria. The first investment has already been made, others are in negotiation.

Genesis Funds selling AZ KLIMA to ČEZ ESCO

07.09.2016ČEZ ESCO, part of the ČEZ Group, agreed with Genesis Private Equity Fund (GPEF II) to acquire the majority share in AZ KLIMA. Minority shareholders will sell their part alongside the majority owner and ČEZ ESCO will thus become the sole owner of the company providing complex services in technical facility management, ventilation and air-conditioning. The transaction is subject to the signing of contractual documentation and approval by the Office for the Protection of Competition.

Genesis is exiting from another company. International group Roth Industries acquires Roltechnik

02.08.2016The ownership of an important Czech manufacturer of sanitary equipment – Roltechnik seated in Třebařov in the region of Pardubice – changed in mid-July of this year. Genesis Private Equity Fund II (GPEF II), owning 90% of the Company, sold its share to the international group Roth Industries. Three senior managers of Roltechnik also sold their shares together with Genesis, therefore Roth Industries is becoming the sole owner of the Company.

Genesis Fund Enters the Pharmaceutical Sector, Acquires QUINTA-ANALYTICA

08.06.2016Genesis Private Equity Fund III (GPEF III), a private equity fund advised by Genesis Capital, has completed the acquisition of 75 % of the company QUINTA-ANALYTICA, an established provider of R&D and regulatory services for pharmaceutical, biotechnology and generic drug industries. It is a first investment for GPEF III, which has approximately 80 million EUR available for investments to small and medium-sized enterprises in Czech Republic and Slovakia.

Genesis Capital: BDO Advisory – new owner of Servodata

18.04.2016Less than five years after entry in Servodata, Genesis Private Equity Fund II (GPEF II) sells its share to a new investor – Czech company BDO Advisory which is part of the fifth biggest global network of audit and consultancy companies. During the Fund´s participation, Servodata that started as a family business developed into a strong group offering a broad portfolio of services in the area of information technologies.

GPEF III: Over EUR 60 million reserved for financing of growth and buyouts of small- and medium- sized enterprises

01.02.2016Last August, Genesis Capital announced the launch of the fourth fund focused on investments on Czech and Slovak SMEs – Genesis Private Equity Fund III (GPEF III). At First Closing, the fund had EUR 45 million at its disposal. Thanks to the considerable interest from investors, the size of commitments has recently passed the EUR 60 million mark (over CZK 1.6 billion). The Fund’s investors include Česká spořitelna, eQ Private Equity and the European Investment Fund, Genesis Capital's long-standing partners. They have been joined by Komerční banka's Investment Company (IKS KB), through which private individuals can invest into Czech and Slovak enterprises alongside their institutional counterparts, together with Kooperativa, Česká podnikatelská pojišťovna, and a local family office.

Traditional investors joined by other reputable institutions in GPEF III. Private individuals can invest in GPEF III via Komerční banka's IKS

01.02.2016Genesis Private Equity Fund III is receiving strong interest from Czech and international investors. The traditional names such as European Investment Fund, Česká spořitelna or eQ Private Equity of Finland have been joined by Komerční banka's Investment Company (IKS KB), Kooperativa and Česká podnikatelská pojišťovna, and a local family office. The final size of the Fund will likely be increased thanks to the continuing demand from international institutional investors.

Genesis Capital’s team to add a prominent lawyer - Pavel Kvíčala, and an investment analyst - Ondřej Hýla.

01.02.2016Genesis Capital’s team to add a prominent lawyer and an investment analyst. Pavel Kvíčala joins Genesis from Havel, Holásek & Partners, Ondřej Hýla has background in consulting, having worked for Deloitte Advisory Services.

Another EUR 45 million for small and medium-sized enterprises. Genesis Capital launches a new private equity fund – GPEF III.

05.08.2015Genesis Capital, one of the largest providers of private equity in the Czech Republic and Slovakia, has announced the launch of a new fund – Genesis Private Equity Fund III (GPEF III), the fourth fund Genesis Capital will have managed in the 15 years since its establishment. As its predecessors, GPEF III will focus on investments into Czech and Slovak small and medium-sized enterprises with high growth potential. At launch time, the fund has EUR 45 million at its disposal, but its size may increase up to EUR 80 million. Investors include Česká spořitelna and the European Investment Fund, Genesis Capital's two long-standing partners. They have been joined by Komerční banka's Investment Company (IKS KB), through which private individuals can invest into Czech and Slovak enterprises alongside their institutional counterparts.

Genesis Capital announces another successful exit: JRC Czech

13.07.2015Genesis Capital, one of the largest providers of private equity in the Czech Republic and Slovakia, has sold its share in JRC Czech, the Czech and Slovak leader in the segment of video games and videogame consoles. During the nearly three years under the ownership of GPEF II Fund, JRC Czech has doubled its sales, providing shareholders with above-average return on their investment. Minority shareholder Slavomír Pavlíček sold his share together with Genesis Capital. JRC Czech is being acquired by Hamaga, a company that has until now mainly specialized in the tourism and development segments. Following the sale of Profimedia and HSW Signall, the deal marks the third successful exit completed by Genesis Capital this year.

Genesis Capital sold its share in HSW Signall

22.01.2015Genesis Capital, one of the largest providers of private equity in the Czech Republic and Slovakia, after nearly two years exited its successful investment in HSW Signall. Over the period when Genesis Capital was a major shareholder with 80% share, HSW Signall succeeded in increasing efficiency and remarkably improved its profitability. The annual sales have grown from 230 million Czech crowns in 2012 to 272 million Czech crowns in 2014. Due to its compelling valuation and a relatively short-term investment period, it is one of the most successful recent transactions by Genesis Capital. Vink Holdings Limited, a member of multinational group Amari Plastics, became the new owner with a 100% share.

Genesis Capital has sold a majority interest in Profimedia, the largest Czech photo bank

19.01.2015Genesis Capital, one of the largest providers of private equity in the Czech Republic and Slovakia, has exited its investment in Profimedia after almost five years. Megiedon, a member of the Scandal Media structure majority-owned by entrepreneur Karel Vágner, has bought sixty percent interest. The new owner acquired the remaining 40% through the purchase of the interest of Petr Novák, founder of Profimedia.

Genesis Capital acquired majority share in Swell

16.06.2014The most important customer of the engineering services provider is Škoda Auto. GPEF II fund managed by Genesis Capital completed within a short timeframe another acquisition. One of the most active private equity funds became the new owner of Swell, spol. s.r.o., a company focused on applied research and development in the automotive industry.

Genesis Capital invests in Slovak company 3070

11.06.2014Genesis Capital, a key player in private equity in the Czech Republic and Slovakia has invested in 3070 Group, a. s. An investment realised through GPEF II fund will strengthen further development of this prospective company dealing with complex solutions in design consultancy and manufacturing of shopper marketing solutions across Europe. For Genesis Capital this marks already fifth investment in Slovakia.

Genesis Private Equity Fund Achieved above Average Returns to its Investors

07.04.2014Genesis Capital, a private equity firm focusing on mid-market investments in the Czech Republic and Slovakia, has announced the successful completion of its investment activities in the Genesis Private Equity Fund (GPEF). The fund was raised in 2003 and made 11 investments. During the period of 2003 to 2013, GPEF more than doubled the value of the portfolio, generating IRR exceeding 20%.

Genesis Capital Acquires a 100% Interest in Sieza

24.11.2013Genesis Capital, one of the largest venture capital fund managers in the Czech Republic, has added another acquisition to its investment portfolio. Through its GPEF II fund, it acquired a 100% interest in Sieza, s. r. o.,a leading Czech provider of services connected with supplying and installing integrated security systems.

Genesis Capital Sells Majority Share in pietro filipi

06.06.2013After nine years, Genesis Capital, one of the largest private equity fund managers in the Czech Republic, is withdrawing from its investment in the retail fashion company pietro filipi. Under the ownership of GPEF I, the fund managed by Genesis Capital, pietro filipi increased its annual turnover from 200 to its current 500+ million CZK.

Servodata Announces the Acquisition of S-COMP Centre

03.06.2013Through this acquisition, Servodata will strengthen its professional services team, especially in the areas of training, virtualized infrastructure and solutions using Microsoft platforms.

Genesis Capital Sold the Company CTS-servis, a.s. to Charvát Group

24.03.2013The largest producer of container technology equipment in the Czech Republic, CTS-servis, is changing ownership. The Company will become part of Charvát Group, a major producer of hydraulic cylinders and related equipment.

Genesis Capital acquires majority stake in HSW Signall

13.03.2013Genesis Capital (Genesis), one of the largest managers of venture capital funds in the Czech Republic, has expanded its investment portfolio by another acquisition. Utilizing its GPEF II investment fund, it has acquired 80% stake in HSW Signall, s.r.o. (HSW), a Czech and Slovak market leader in the supply of materials and technologies for advertising production and wide-format printing.

Genesis Capital Acquired a Majority Stake in KS Klima-Service a.s.

12.12.2012Genesis Capital, one of the largest private equity fund managers in the Czech Republic, expanded its investment portfolio with another acquisition. Through its GPEF II fund, it acquired a majority interest in the Dobříš-based KS Klima-Service a.s., a market leader on the Czech market in manufacturing and development of air filters and filtering equipment.

Game Czech Buys the Slovak Brand Brloh

11.11.2012Two months after the completion of the acquisition of Game Czech, Genesis Capital announces a major expansion of the Company’s operations. At the end of October, Game Czech bought the established Slovak brand Brloh. Under that name, it will operate a network of Slovak shops.

Genesis Capital Buys Game Czech

13.08.2012The latest investment will help the expansion of the Czech market leader in the area of computer games and gaming consoles. The company Game Czech a. s., the Czech market leader in the broad retail segment of computer games and game consoles, has a new major investor. Genesis Capital, the manager of several successful private equity funds, has bought 100 % of the Company on behalf of its investors.

Ondřej Vičar Becomes a Partner in Genesis Capital

20.03.2012Genesis Capital, one of the largest private equity fund managers in the Czech Republic and Slovakia, will have a new partner as of 1 March 2012 – investment manager Ondřej Vičar.

VYDIS Strengthens Its Position by Buying Two Companies – CESA and ŠINDY

14.01.2012The new group plans to position itself among Czech ICT market leaders VYDIS, a leading Czech supplier of ICT solutions, made significant progress in its plan to become one of the most significant players on the market. VYDIS has successfully completed the acquisition of CESA and ŠINDY, thereby significantly expanding the scope of the services offered by the newly formed group. Both acquisitions, which will serve as a springboard for further expansion on the domestic market for VYDIS, have been planned since 2010, when the private equity fund GPEF II managed by Genesis Capital became the majority owner of VYDIS.

The GPEF Fund Has Already Appreciated Its Investor’s Investments by More Than One Hundred Percent

01.01.2012The private equity fund GPEF, managed by Genesis Capital and focused on investments into small and medium-sized enterprises in the Czech Republic and Slovakia, achieved extraordinary success. After the completion of the sale of the nearly 40-percent share in the Gumotex company, the total appreciation of the funds invested into the Fund surpassed 100 percent.

The Ownership Structure of the Břeclav-Based Gumotex Company Has Changed

30.11.2011Prague, December 1, 2011 The Břeclav-based joint stock company, Gumotex, the largest domestic manufacturer of bed mattresses and products using polyurethane foam, has changed its ownership structure. The close to 40 percent interest in the company, which had been owned by Genesis Capital, has now been taken over and purchased by the other current shareholders – a consortium made up of the investment companies, Milestone Partners and Expandia – and the CEO of Gumotex, Mr. Jiří Kalužík. Genesis Capital, which is one of the largest private equity firmsin the Czech Republic, has successfully completed a transaction, which began with an initial investment into Gumotex dating back to 2006.

Office for the Protection of Competition Approves Genesis Capital’s Investment into Servodata

21.09.2011The Czech Office for the Protection of Competition approved the investment of Genesis Capital into the company Servodata. Genesis Capital acquired a majority interest in Servodata effective as of August 31, 2011. This investment is the result of an agreement reached between the established Czech private equity fund and a major Central European provider of information services and communication solutions. The new funding will enable a further expansion of Servodata in its key markets of the Czech Republic and Slovakia.

Genesis Capital acquired majority in the ICT company Servodata

31.08.2011Genesis Capital, a leading private equity firm in the Czech Republic, acquired a majority stake in the company Servodata, an established Central European supplier of information and communication solutions. The investment via the GPEF II fund will become the foundation for a further development of Servodata primarily on the Czech and Slovak markets.

Genesis Capital has acquired a majority in AZ KLIMA

22.08.2011Genesis Capital, a leading private equity firm in the Czech Republic, expanded its investment portfolio with another acquisition. Its GPEF II Fund completed a leveraged buy-out of a 66% stake in the Brno-based company AZ KLIMA s.r.o., one of the national leaders in the field of air-handling solutions.

Genesis Capital sold ESB Rozvaděče

27.07.2011Genesis Capital, a leading private equity firm in the Czech Republic, sold ESB Rozvaděče to ESB Elektro, a company formed for this purpose by the former and current managers of ESB Brno and by one external investor. The price of the transaction was not disclosed.

Penta acquires AB Facility

15.12.2010Penta, a Central European investment group, has entered the facility management market with its new acquisition. Today, Penta and the Genesis Private Equity Fund, managed by Genesis Capital, concluded a purchase agreement for AB Facility. AB Facility is currently among the three most important providers and integrators of facility management on the Czech market. The transaction is subject to approval by the Anti-monopoly Office and its value will not be disclosed.

A new powerful group being created in the corporate catering market

07.12.2010Genesis Capital has become the owner of the GTH Catering and MULTI-Catering companies

Genesis Capital bought Vydis

06.10.2010Vydis, an important information and telecommunications technology services and solutions supplier, is planning dynamic growth under the wings of Genesis Capital

Genesis Capital Finds Strategic Investor for JM-montáže

30.06.2010New Owner of JM-montáže is GA Energo technik

Expansion of the Largest Czech Photo Bank to Be Supported by a New Investor

02.06.2010Genesis Private Equity Fund II Acquires Majority Share in Profimedia

The Genesis Private Equity Fund II

29.06.2009Genesis Capital Announces First Closing of a New Private Equity Fund Focused on the Czech Republic and Slovakia - the Genesis Private Equity Fund II